Condo Insurance in and around Rifle

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

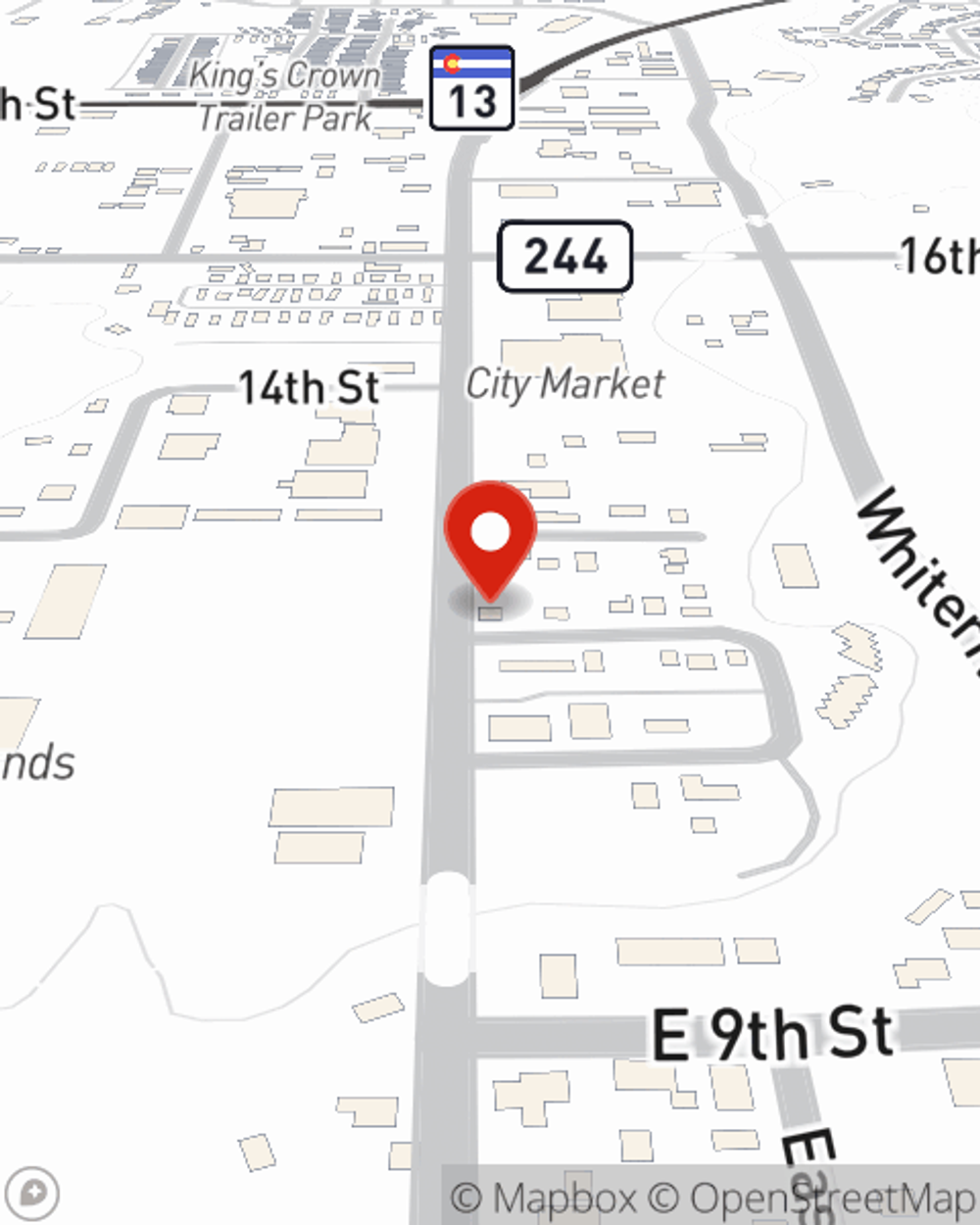

- Rifle

- Silt

- Debeque

- New Castle

- Parachute

- Battlement Mesa

- Glenwood Springs

Welcome Home, Condo Owners

Life happens.. Whether damage from weight of ice, fire, or other causes, State Farm has wonderful options to help you protect your condominium and personal property inside against unpredictable circumstances.

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Safeguard Your Greatest Asset

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Amy Baysinger is ready to help you prepare for potential mishaps with dependable coverage for all your condo insurance needs. Such individual service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If if trouble knocks on your door, Amy Baysinger can help you submit your claim. Keep your condo sweet condo with State Farm!

As one of the leading providers of condo unitowners insurance, State Farm has you covered. Visit agent Amy Baysinger today for help getting started.

Have More Questions About Condo Unitowners Insurance?

Call Amy at (970) 625-5678 or visit our FAQ page.

Simple Insights®

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Amy Baysinger

State Farm® Insurance AgentSimple Insights®

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.